- PDF Version

Toronto, Ontario, 29 October 2025 | The Newswire | – Helix BioPharma Corp. (TSX: “HBP”, OTC: “HBPCF”, FRANKFURT: “HBP0”) (“Helix” or the “Company”), a clinical-stage oncology company shaping a near future where today’s hard-to-treat cancers are vincible, today announced financial results for the 2025 fiscal year ended July 31, 2025.

Overview

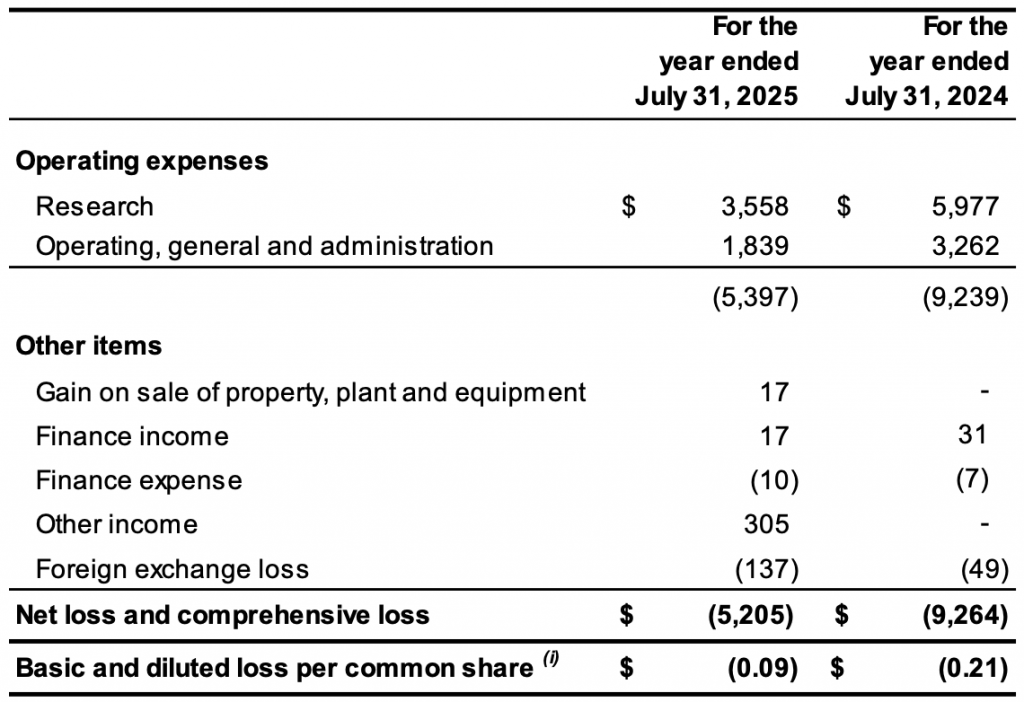

The Company reported a net loss and total comprehensive loss of $5,205,000 for the year ended July 31, 2025, (July 31, 2024: $9,264,000) and a loss of $0.09 per common share (July 31, 2024: loss of $0.21 per common share.

Clinical Development

In the second half of 2024, the Company conducted an extensive review of its assets and forward strategy, that resulted in the following key decisions:

- The Company decided to focus its resources on developing L-DOS47 as a combination therapy with PD-1 inhibitor, pembrolizumab, as first-line therapy for Non-Small Cell Lung Carcinoma (NSCLC). This decision was the result of an extensive expert review of available pre-clinical and clinical data on L-DOS47, the significant unmet medical need in NSCLC despite the emergence of immunotherapy as the standard of care, and an assessment of where a pharmacological tumor alkalization therapy is most likely to deliver meaningful clinical impact in the near term, also keeping in mind the shortest time to FDA approval.

- On August 9, 2024 and August 13, 2024, the research collaborations with University of Tuebingen, Germany, and Peter Mac, Australia, respectively, were terminated. Projects with these institutions were outside the scope of the new focus on NSCLC.

- The Company resolved to close its laboratory in Edmonton Canada, which was closed on 31 October, 2024, with liquidation of laboratory equipment and safekeeping of documents, reagents, and lab samples with a third-party storage provider.

- The Company reviewed its CMC practices and entered discussions with several Contract Drug Manufacturing Organizations to optimize both resource expenditure as well as plan for manufacturing of the next batch of drug in advance.

The Company’s Phase Ib/II combination trial in metastatic pancreatic adenocarcinoma (LDOS006) evaluating the safety and tolerability of L-DOS47 in combination with doxorubicin was completed in October 2024. Data and sample analyses are ongoing with the Clinical Study Report (CSR) expected to be issued fall 2025.

LDOS007 is a new Phase Ib/Randomized Phase II, open label study to assess L-DOS47 in combination with pembrolizumab as first-line therapy in NSCLC, currently in the planning stage. The Company received positive and constructive feedback in writing from the U.S. Food and Drug Administration (FDA) on the study design of LDOS007 on August 8, 2025, ahead of a planned End-of-Phase I (EOP1) meeting that was scheduled with the FDA via videoconference on August 13, 2025. As the FDA indicated that the Company could proceed without the meeting if the written feedback was sufficiently clear, and given that no additional discussion was deemed necessary, the Company elected to forego the videoconference in favor of preparing the Clinical Trial Application (CTA) as the next step in its interactions with the Agency. The study design will include an initial dose escalation safety lead-in investigating low, medium and high L-DOS47 dose levels in combination with standard pembrolizumab, followed by a randomized Phase II arm to test two selected L-DOS47 dose levels in combination versus standard pembrolizumab alone.

Corporate Development

- On September 5, 2025, the Company announced it will not proceed with the previously announced equity draw-down subscription facility with GEM Global Yield LLC SCS and GEM Yield Bahamas Limited (together, “GEM”), given that the Company determined that the GEM facility no longer aligns with its capital strategy or its commitment to maximizing long-term shareholder value.

- On August 22, 2025, the Company closed its non-brokered private placement of 2,222,333 common shares of the Company at a price of $0.75 per Common Share for gross proceeds of $1,667,000.

- On August 13, 2025, the Company announced the publication of a peer-reviewed article by Frontiers in Oncology reporting results from a previously completed Phase I/II clinical study of L-DOS47 as a single agent in patients with advanced non-small cell lung cancer (NSCLC) and titled “Safety of unconventional antibody-drug conjugate L-DOS47 in a Phase I/II monotherapy study targeting advanced NSCLC”.

- On June 16, 2025, the Company completed filing of the Company’s interim financial statements for the nine months ended April 30, 2025 (the “Financial Statements”), the management’s discussion and analysis relating to the Financial Statements, and the CEO and CFO certifications relating to the Financial Statements (collectively, the “Interim Filings”).

- On June 2, 2025, the Company announced appointment of Rohit Babbar as Chief Financial Officer (“CFO”) of the Company, replacing James B. Murphy. Mr. Babbar is further supported by an experienced team specializing in accounting and finance, capital raising and administrative operations via Brio Financial Group, a US-based financial and management consulting firm, of which Mr. Babbar is a Director.

- On May 20, 2025, the Company closed the Laevoroc asset acquisition transactions, acquiring substantially all of the assets and certain liabilities of Laevoroc Immunology AG and Laevoroc Chemotherapy AG, in consideration for the issuance of 11,555,076 common shares at a fair value of $9,880,000 and 9,454,153 common shares at a fair value of $8,083,000, respectively.

- On April 24, 2025, the Company announced appointment of Veronika Kandziora as Chief Operating Officer (“COO”).

- On April 21, 2025, the Company issued 125,000 common shares for the exercise of 125,000 stock options for cash proceeds of $113,000.

- On April 10, 2025, the Company announced appointment of Thomas Mehrling, MD, PhD as Chief Executive Officer (“CEO”), taking over from Jacek Antas, who continues to be a Director and the Chairman of the Board.

- On March 26, 2025, the Company announced the voting results from the Annual and Special Meeting of its Shareholders (“the Meeting”), which was held on the same day. A total of 40,294,667 common shares were voted at the Meeting, representing 76% of the Company’s total issued and outstanding shares, with all items of business approved by an overwhelming majority of the shares represented (>99.5%).

- On March 18, 2025, the Company completed filing of the Company’s interim financial statements for the three and six months ended January 31, 2025 (the “Financial Statements”), the management’s discussion and analysis relating to the Financial Statements, and the CEO and CFO certifications relating to the Financial Statements (collectively, the “Interim Filings”).

- On January 8, 2025, the Company closed its private placement financing for gross proceeds of $3,000,000 from the issuance of 4,000,000 common shares at a price of $0.75 per common share. In connection with the closing, the Company paid a cash fee of 10% of gross proceeds raised to an eligible finder.

- On November 8, 2024, the Company announced the resignation of its Chief Financial Officer (“CFO”) and Corporate Secretary, Praveen Varshney, with immediate effect. On December 11, 2024, the Company appointed James B. Murphy as its Chief Financial Officer (“CFO”).

- Effective September 30, 2024, the Company changed its registrar and transfer agent from Computershare Trust Company to Endeavour Trust Corporation.

- On September 10, 2024, the Company commenced trading on the Frankfurt Boerse under the trading symbol “HBP0”.

- Effective August 16, 2024, the common shares of the Company commenced trading on a 1-for-5 consolidation basis under the new CUSIP number 422910208 and existing stock symbol “HBP”.

Research & Development

Research & Development expenses for the year ended July 31, 2025, totaled $3,558,000 (2024: $5,977,000). The following table outlines research and development cost expenses for the current and comparative year (in thousands of Canadian dollars):Research and development expenditures for the year ended July 31, 2025, when compared to the year ended July 31, 2024, decreased by $2,419,000 or 40%. The change in spending during the year was the net effect of the conclusion of the Phase Ib/II study in metastatic pancreatic adenocarcinoma (LDOS006), collaborative research activities carried out by third parties on behalf of the Company, and stock-based compensation expenses based on the timing of the vesting of stock options issued to employees and consultants associated with research activities in the quarters ended July 31, 2025 and 2024.

Operating, General and Administration

Operating, general and administration expenses for the year ended July 31, 2025, totaled $1,839,000 (2024: $3,262,000). The following table outlines operating, general and administration expenses for the current and comparative years (in thousands of Canadian dollars):

Operating, general and administration expenses for the year ended July 31, 2025, when compared to the year ended July 31, 2024, decreased by $1,423,000 or 43%, primarily due to changes in service providers relating to accounting and tax, legal, consultants and business development.

Liquidity and Capital Resources

Since its inception, the Company has mainly relied on financing its operations from public and private sales of equity. The Company does not have any credit facilities and is therefore not subject to any externally imposed capital requirements or covenants. The Company manages its liquidity risk by continuously monitoring forecasts and actual cash flow from operations and anticipated investment and financing activities.

The Company reported a net loss and total comprehensive loss of $5,205,000 or $0.09 per common share for the year ended July 31, 2025, (July 31, 2024: $9,264,000 or $0.21 per common share). As of July 31, 2025, the Company had a working capital deficiency of $2,807,000, shareholders’ deficiency of $15,586,000 and an accumulated deficit of $215,876,000.

On January 8, 2025, the Company closed its private placement financing for gross proceeds of $3,000,000 from the issuance of 4,000,000 common shares at a price of $0.75 per common share. In connection with the closing, the Company paid a cash fee of 10% of gross proceeds raised to an eligible finder.

On April 21, 2025, the Company issued 125,000 common shares for the exercise of 125,000 stock options for cash proceeds of $113,000.

On May 20, 2025, the Company closed the Laevoroc asset acquisition transactions, acquiring substantially all of the assets and certain liabilities of Laevoroc Immunology AG and Laevoroc Chemotherapy AG, in consideration for the issuance of 11,555,076 common shares at a fair value of $9,880,000, and 9,454,153 common shares at a fair value of $8,083,000, respectively.

On August 16, 2024, the Company completed a one-for-five (1:5) consolidation of all of its issued and outstanding common shares, resulting in a reduction in the issued and outstanding shares from 245,107,749 to 49,021,536 common shares. Shares reserved under the Company’s equity and incentive plans were adjusted to reflect the Consolidation. The Consolidation was approved by the Company’s shareholders at the Annual General Meeting held on January 18, 2024 and became effective on August 16, 2024. No fractional common shares are issued in connection with the Consolidation, which are, if any, deemed to have been tendered by its registered owner to the Company for cancellation for no consideration.

As at July 31, 2025, the Company’s cash reserves of $65,000 are insufficient to meet anticipated cash needs for working capital and capital expenditures through the next twelve months, nor are they sufficient to see the current research and development initiates through to completion. To the extent that the Company does not believe it has sufficient liquidity to meet its current obligations, management considers securing additional funds primarily through equity arrangements to be of utmost importance.

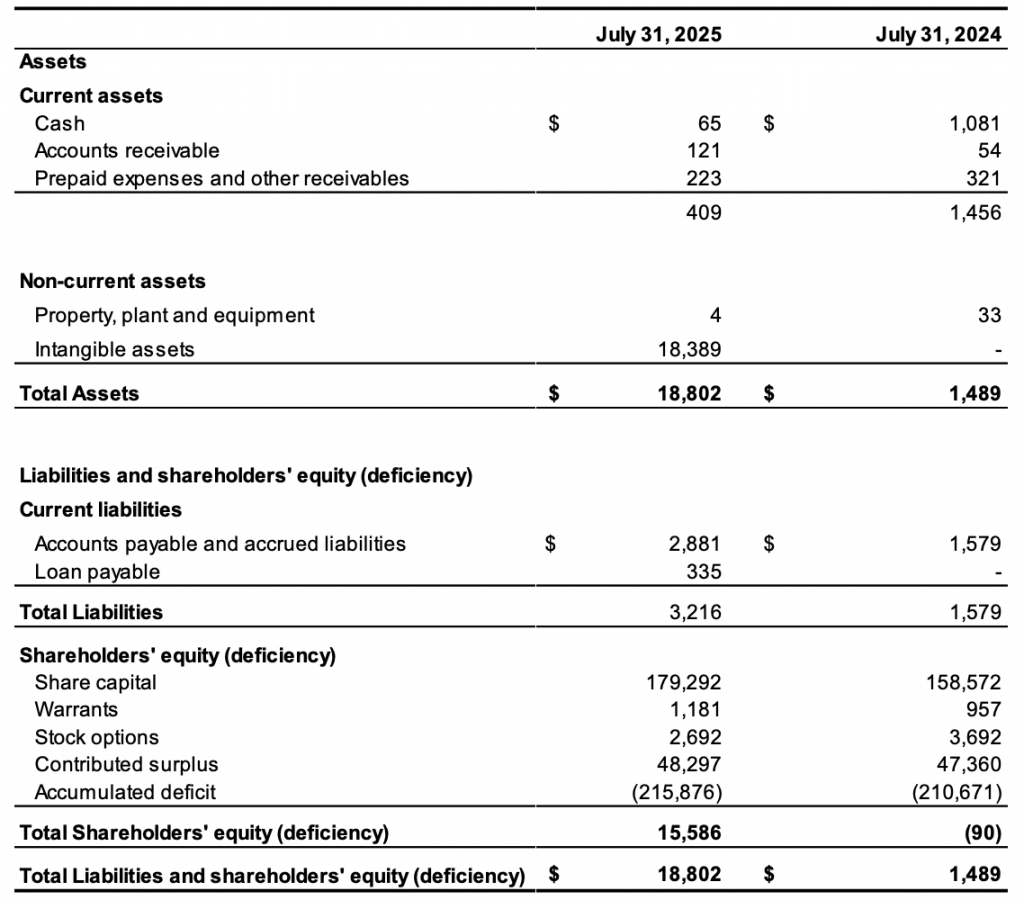

The Company’s Statement of Financial Position and Statement of Net Loss and Comprehensive Loss for the fiscal year 2025 and 2024 are summarized below:

Statements of Financial Position in Thousands of Canadian Dollars

Statements of Net Loss and Comprehensive Loss in Thousands of Canadian Dollars

The Company’s financial statements, management’s discussion and analysis and annual information form will be filed under the Company’s profile on SEDAR+ at https://www.sedarplus.ca/, as well as on the Company’s website at www.helixbiopharma.com.

About Helix BioPharma Corp.

Helix BioPharma is an oncology company that innovates from strength to bring near-term solutions for today’s hardest-to-treat cancers. The Company’s pipeline is led by Tumor Defense Breaker™ L-DOS47, a clinical-stage antibody-enzyme conjugate designed to prime CEACAM6-expressing tumors for increased sensitivity to therapy and augment the effectiveness of today’s front-running anti-cancer treatments. L-DOS47 has completed Phase Ib studies in non-small cell lung cancer (NSCLC) and shares its CEACAM6-targeting foundation with Helix’s next-generation bi-specific antibody-drug conjugates (ADCs), currently in discovery. The Company also advances two pre-IND candidates: (i) LEUMUNA™, an oral immune checkpoint modulator aimed at achieving durable remission in post-transplant leukemia relapse, and (ii) GEMCEDA™, a first-in-class oral gemcitabine prodrug with bioavailability on a par with IV, designed to expand treatment options for advanced cancers.

Helix is listed on TSX (HBP), OTC PINK (HBPCD), and FWB (HBP0). For more information, please visit: https://www.helixbiopharma.com/

For more information, please contact:

Helix BioPharma Corp.

Bay Adelaide Centre – North Tower

40 Temperance Street, Suite 2

Toronto, ON M5H 0B4

Tel: +1 857 208 7687

Thomas Mehrling, CEO

corporate@helixbiopharma.com

Forward-Looking Statements and Risks and Uncertainties

This news release contains forward-looking statements and information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities laws. Forward-looking statements are statements and information that are not historical facts but instead include financial projections and estimates, statements regarding plans, goals, objectives, intentions and expectations with respect to the Company’s future business, operations, research and development, including the Company’s activities relating to Tumor Defense Breaker™ L-DOS47, LEUMUNA™ and GEMCEDA™. Forward-looking statements can further be identified by the use of forward-looking terminology such as “ongoing”, “estimates”, “expects”, or the negative thereof or any other variations thereon or comparable terminology referring to future events or results, or that events or conditions “will”, “may”, “could”, or “should” occur or be achieved, or comparable terminology referring to future events or results.

Forward-looking statements are necessarily based on a number of estimates and assumptions that the Company considered appropriate and reasonable as of the date such information is given, including but not limited to the assumptions regarding the implied benefits of the transactions. Forward-looking statements are subject to known and unknown risks, uncertainties, and other factors, many of which are beyond the Company’s control, that may cause actual results, performance or achievements to be materially different from those expressed or implied by such forward-looking statements, including but not limited to the risk that the Company’s assumptions on which its forward-looking statements are based may not be accurate; the ability of the Company to capitalize on the potential benefits of the transactions; and the risk factors disclosed in the Company’s periodic reports publicly filed and available on its SEDAR+ profile at www.sedarplus.ca. No assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur. There is no assurance that the proposed transactions will be completed in accordance with its terms or at all. The forward-looking statements contained in this news release are made as of the date of this announcement and the Company does not assume any obligation to update any forward-looking statement or information should those beliefs, assumptions, opinions or expectations, or other circumstances change, except as required by law.